Health, Wealth & Purpose in Retirement

THE SECRET TO LONGEVITY

with Grandma Possibility

Health, Wealth & Purpose in Retirement

THE SECRET TO LONGEVITY

with Grandma Possibility

Welcome!

It's Pam here, otherwise known as ‘Grandma Possibility’. That crazy 70-something year old... who changed her water and it changed her life.

For most people, retirement marks a finish line. For me, it was the beginning of a story I never knew I would write.

It came as I navigated my challenges post-retirement. What was supposed to be endless days of travel, fun, fulfilment, family and relaxation, was in reality a stressful period of deteriorating health, funds and purpose.

Despite my careful saving and planning, retirement brought the realisation that my finances weren't enough to support the life I'd envisioned.

My travel plans were capped, and the luxuries I'd hoped for were limited by a tight budget.

Years of hard work had taken a toll on both my physical and mental well-being. Burnout, fatigue, and a decline in cognitive sharpness became apparent, highlighting the toll retirement can take on health.

The loss of my professional identity left me feeling adrift, struggling to find purpose in this new chapter of life. Witnessing the aimless retirement of others only added to my uncertainty.

I wasn't alone.

Every where we looked, more and more baby boomers were experiencing the same.

In conversations, this was considered 'the norm'.

What a disappointment that was!

Now, I could have just accepted this was my reality. Like I had most things in my life.

But something didn't sit right.

I didn't want to deteriorate like I had seen so many do.

I have 2 wonderful children, 7 inspiring Grandchildren and 6 great granchildren that I want to see grow up.

And I don't just want to be that oldie sitting in the chair. I want to be the Fun grandma who is living life with them.

Little did I know how this would happen.

All I knew is that it would.

Then one day in 2022, my eldest Grandaughter turned up for a visit, with this little white machine that powerfully changed our water and as a result - my life.

First with my Health

Then with the Mind and a whirlwind of personal growth and discovery

And now with the Wealth and Impact that I get to share.

That's why I am here.

To help you experience the same.

To offer you a chance to redefine retirement and live life on your terms.

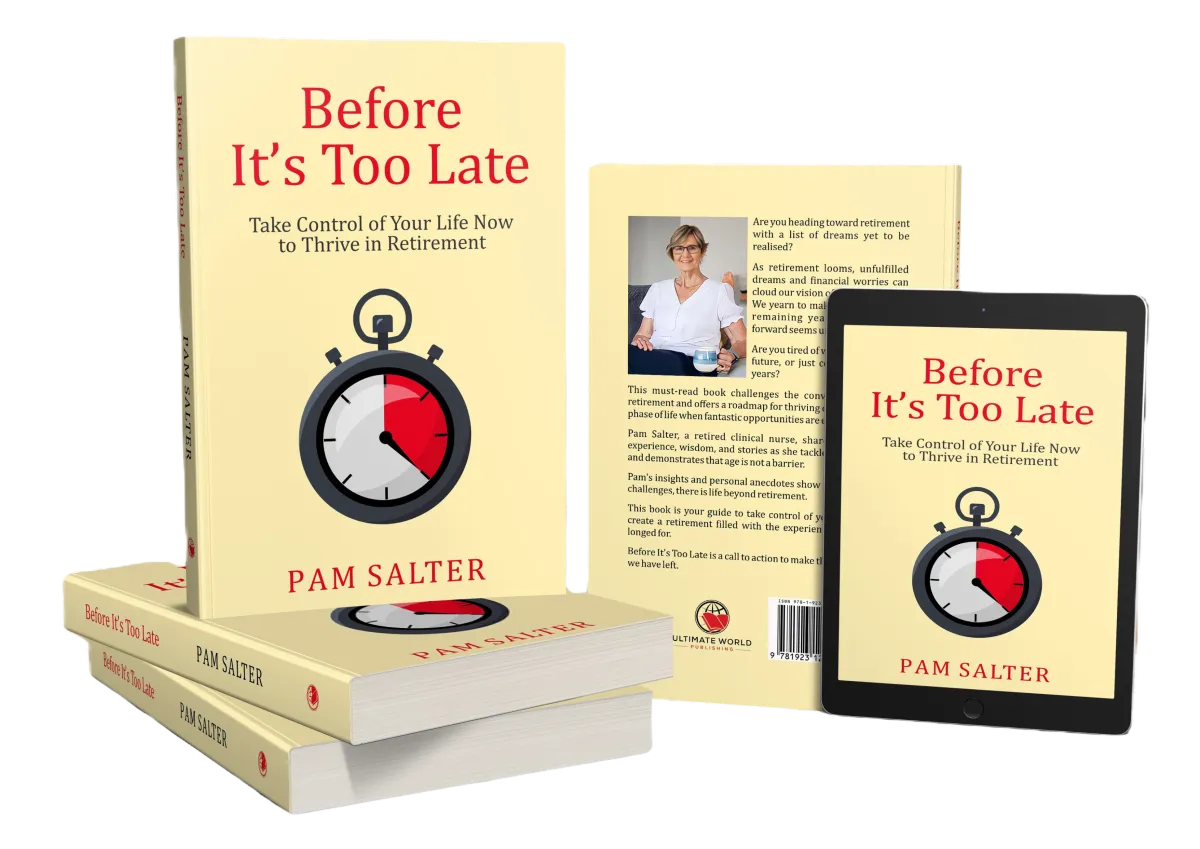

You can read more about this, in my book "Before It's Too Late". A heartfelt guide to navigating retirement transitions, and the launch of a semi-automated online business dedicated to empowering retirees to embrace their later years with confidence.

Allow me to be the proof you need to see that retirement can be a time of vibrancy and fulfilment.

Let my experiences inspire you to find joy and purpose in your post-work years.

Let's connect, uplift and empower our generation to seize the boundless opportunities that retirement offers with enthusiasm and optimism.

I can't wait for you to explore this website that has been carefully designed with you in mind.

Much love,

Pam.

Grandma Possibility

Author, Solution Sharer, Retirement Advocate

BEFORE IT'S TOO LATE

Are you nearing retirement with dreams still on hold?

Don't let worries about the future dim your vision of what's possible. Instead of just counting down the years, find inspiration in 'Before It’s Too Late.'

In this must-read book, retired clinical nurse Pam Salter shares her wisdom and stories, challenging the traditional view of retirement.

Discover how to thrive in this vibrant phase of life, where opportunities abound. Pam's insights prove that age is no barrier to living fully.

Take control of your life now and create the retirement you've always wanted. Don't wait until it's too late – start making the most of your time today.

BLOGS OF INSIGHT

For my readers:

Work to Live – NOT - Live to Work

Work to Live – NOT - Live to Work

Retirement is often viewed as a time of relaxation, adventure, and fulfilment—a well-deserved reward after a lifetime of hard work.

Health-Related Pitfalls:

Health-related issues can also significantly impact retirees' quality of life.

The Australian Institute of Health and Welfare (AIHW) provides insights into the health challenges faced by retirees. A study conducted by AIHW found that approximately 80% of Australians aged 65 and over reported experiencing at least one chronic health condition. These conditions, ranging from arthritis to cardiovascular disease, can impact retirees' daily lives and overall well-being.

Maintaining physical and mental wellness becomes increasingly crucial as retirement age approaches.

Forming good habits such as regular exercise, a balanced diet, adequate hydration and routine health screenings can help prevent or manage many age-related health conditions.

However, despite these efforts, some retirees may still find themselves grappling with health-related limitations.

Take Jane, for example, who retired with plans to travel and pursue her passions but like many, she had worked harder and longer than she originally planned and found herself burnt out and her health declining in those last decades of her working life.

She found herself grappling with fatigue and mobility issues that prevented her from enjoying her retirement to the fullest, struggling to play with her grandchildren in ways she had envisioned.

Simple tasks like getting out of bed in the morning became daunting challenges, leaving her feeling frustrated and isolated.

To avoid similar setbacks, retirees should prioritise their health and wellness long before retirement age, self-care is one of the most precious gifts you can give yourself.

Ensure you have those conversations with family members letting them know your care preferences if you were unable to care for yourself as planned can provide peace of mind in the face of potential health challenges.

Adopting healthy lifestyle habits such as:

· Staying Active: Regular exercise, such as walking, swimming, or yoga, can help maintain physical and mental health.

· Healthy Eating: A balanced diet plus adequate hydration with plenty of fruits, vegetables, whole grains and clean water can help prevent health issues.

· Social Connections: Maintaining relationships with family and friends or joining clubs and groups can combat feelings of isolation.

· Hobbies: Exploring new hobbies or continuing with existing ones can provide enjoyment and purpose.

· Learning: Engaging in lifelong learning through classes, workshops, or online courses can keep the mind sharp.

· Volunteering: Giving back to the community through volunteering can provide a sense of purpose and fulfilment.

· Mindfulness and Relaxation: Practicing mindfulness, meditation, or relaxation techniques can reduce stress and improve well-being.

· Routine Health Check-ups: Regular visits to healthcare providers for screenings and check-ups can help maintain optimal health.

· Healthy Sleep Patterns: Routine bedtimes and daytime rest when needed.

Financial Pitfalls:

Financial security is a cornerstone of a successful retirement, yet many retirees find themselves grappling with unexpected challenges.

According to the Australian Bureau of Statistics (ABS), a survey conducted in 2018 revealed that only around 50% of retirees reported living the life they had envisioned financially.

This suggests that a significant portion of retirees in Australia may face financial challenges in retirement as the reality can sometimes fall short of these expectations, especially if retirees haven't adequately prepared.

This is where the importance of early retirement planning becomes apparent.

By developing a retirement strategy two decades before retirement age, individuals can mitigate common pitfalls and pave the way for a more secure and fulfilling retirement.

According to recent studies, only a fraction of retirees actually live the life they envisioned financially. One of the primary reasons for this discrepancy is inadequate financial planning during their working years.

Throughout their careers, individuals are encouraged to save diligently for retirement through employer-sponsored plans and individual retirement accounts. While these vehicles are essential for building a nest egg, they may not be sufficient on their own.

Inflation, market fluctuations, and unforeseen expenses can all erode retirement savings if not accounted for.

Consider the case of John, a retiree who diligently contributed to his supernation throughout his career. However, upon retiring, he found that his savings were not enough to maintain his desired lifestyle.

Rising healthcare costs, home repairs, and other unforeseen expenses quickly depleted his nest egg, leaving him financially strained in his golden years.

To avoid falling into a similar trap, retirees must adopt a proactive approach to financial planning.

This includes regularly reviewing and adjusting their investment portfolio, accounting for inflation and potential healthcare expenses, and seeking professional guidance when necessary.

Psychological Challenges:

Beyond financial and health-related concerns, retirees may also grapple with psychological challenges as they transition into this new phase of life.

Research conducted by Beyond Blue, an Australian mental health organization, suggests that mental health issues, such as depression and anxiety, are prevalent among older adults in Australia.

While specific statistics on retirees' psychological challenges may vary, it's estimated that around 10-15% of older Australians experience depression, with rates increasing with age.

These statistics provide valuable insights into the common pitfalls faced by retirees in Australia, emphasising the importance of comprehensive retirement planning that addresses financial, health, and psychological well-being

Retirement often marks a significant shift in identity and purpose, as individuals move away from their careers and into a more leisure-oriented lifestyle.

Many retirees derive a sense of purpose and fulfilment from their careers, making the transition to retirement particularly challenging.

Without the structure and routine provided by work, retirees may struggle to find meaning in their daily lives.

This loss of purpose can lead to feelings of boredom, depression, and isolation if not addressed proactively.

Cathy’s story serves as a poignant example of this phenomenon. After retiring from a fulfilling career, she found himself at a loss for what to do with her newfound free time.

Despite her best efforts to fill her days with hobbies and activities, she couldn't shake the sense of emptiness that accompanied his retirement.

It wasn't until she discovered an online opportunity where she learnt to communicate in the digital space with people who shared the same values and interests and were part of a broader global community that she regained a sense of purpose and connection in retirement.

To navigate these psychological challenges, retirees must actively cultivate a sense of purpose and connection in their post-career lives.

This may involve exploring new hobbies, volunteering, or pursuing lifelong passions such as writing a book that were previously put on hold.

Additionally, maintaining social connections with friends, family, and peers can provide invaluable support and companionship during this transition

Developing a Retirement Strategy:

In light of these common pitfalls, developing a comprehensive retirement strategy is essential for ensuring a smooth transition into retirement.

Rather than waiting until the last minute, individuals should begin planning for retirement at least 20 years in advance, if possible.

A robust retirement strategy encompasses not only financial considerations but also health and psychological well-being.

Here are some key steps to consider when developing a retirement plan:

· Start Early: The earlier individuals begin saving and investing for retirement, the better. Compound interest can work wonders over time, allowing retirement savings to grow substantially with relatively modest contributions.

· Additional Income Stream: Research opportunities for an online income in those years prior to retirement. This can not only help financially but adds to your financial and emotional well-being through online communities and connections.

· Regularly Review Financial Plan: Retirement planning is not a one-and-done task. Individuals should regularly review their financial plan, adjusting their savings and investment strategies as needed to stay on track towards their retirement goals.

· Prioritise Physical and Mental Health: Health is wealth, especially in retirement. Retirees should prioritize their physical and mental well-being by adopting healthy lifestyle habits, staying active, and seeking medical attention when needed.

· Cultivate Purpose and Connection: Retirement is not just about financial security—it's also about finding fulfilment and meaning in this new phase of life. Retirees should actively seek out activities, hobbies, and social connections that bring joy and purpose to their days.

Conclusion:

In conclusion, navigating retirement successfully requires careful planning and preparation.

By addressing common pitfalls such as financial insecurity, health-related challenges, and psychological barriers, individuals can pave the way for a more secure and fulfilling retirement experience.

By developing a retirement strategy 20 years in advance, retirees can set themselves up for success and enjoy their later years to the fullest.

RETURN TO HOMEOSTASIS

WITH KANGEN WATER

The Water that Changed My Life

MOLECULAR HYDROGEN RICH

High levels of Molecular Hydrogen, giving the water a very powerful antioxidant property

Neutralizes free radicals, protecting our body and slowing down aging

MINERAL RICH

Contains essential alkaline minerals: calcium, potassium and magnesium in an ionic form, that can easily be assimilated into your body

DETOXIFYING

Removes acid waste and toxins efficiently

Helps detoxify the colon Faster circualtion of water

DIGESTIVE HEALTH

Effective against chronic diarrhea, indigestion, abnormal

stomach or intestine fermentation, acid control, and acid indigestion

+60 uses - 7 levels of pH produced

8.5 - 9.5 pH: drinking and cooking water

2.5 pH: disinfection - kills 99.9% of bacteria,mold, viruses and fungus

6 pH : skin toner, water plants and cleaning

Ready to breathe new life into your digital presence?

More Enagic Products

Enagic has been a leading company since 1974 in global health and wellness with its primary mission to provide individuals access to clean, healthy water through its alkaline water ionisers......

Don't just take my word for it.

Hear from others who have changed their water and their life with it!

Denise G Turner

"When I was 26 I joined a low ticket MLM company to work around my 3 children.

Never seeing a business model like this before excited me and led me on my entrepreneurial path. I was with that company for 26 years and woke up one day realising I was spending more than I was making.

I had also returned back to work in that time and was in disability and aged care.

Turning 50 l knew I wanted more. Working with a nurse who was 72 was huge wake up call - I didn't want that for me. I went searching for something online that was automated and I could build around my job and this is when I was introduced to Kangen Water.

Not only could I improve my health, but I could create an income around it too!

Now, I'm in the best physical condition of my life. I no longer work for a boss, I’ve retired my husband. I travel the world for 'work'

and get to share this life changing opportunity with others, all from my phone."

Kathryn Campbell

"For the past 40 years, I've dedicated my life to caring for others within them disability sector.

However, at 55, I reached a crossroads.

The unexpected loss of my mother at 51 made me realise the fragility of life and I felt like I was merely existing,

I knew I needed a change.

I turned to the online space in search of something. That’s when I stumbled upon a post from a mentor, an everyday woman just like me, who was committed to having more family time, fun, and freedom.

Her words resonated with me deeply, I knew I had found my path forward.

When I realised all I had to do to start was invest in water technology to improve the quality of our drinking water,

with a chance to improve mine and my families health while making and saving us money - it was a no brainer.

Now I'm living my "yes" life. Ive regained my energy, reconnected with friends, and created more abundance for myself.

While I keep my care work, my true passion lies in helping others find their freedom and purpose.

What I love most about this opportunity is the sense of community it has created and the endless possibilities it offers to

transform our idea of retirement. I'm excited about my future and the new heights we can reach together."

Coralee Asker

I had seen the water machine and wanted one from first sight I wasn’t sure how I would get one and let it drop I saw a young woman who had been my PT doing well online and asked her what she was up to.

She suggested I look at a webinar before she gave me any more information

I looked at the automated information and at that time I wasn’t even sure what it was but I knew that I wanted more from life.

After having a good look into why I wanted more money in my life I chatting to the Digital Business Specialist

that answered any questions I might have had.

Once I realised it was the machine I wanted for my health and home I jumped .

I was blessed with the option of finance which made the option way easier as I was my husbands carer on a pension.

It truely helped me to look at my life, change my life and want to give the opportunity to others No regrets that I took the leap of being in charge of my own destiny what so ever I would do it again in a heartbeat.

Leanne Lingard

"For me, I was l was looking for a way to increase my income and set my retirement up. When looking through all the options, I chose to partner with Enagic because not only did its product match my values with Health. I felt safe and confident knowing that it is a member of the Direct Selling Association which means it has ticked all of the boxes as far as reputation and credibility.

I wanted to reclaim my life after working shiftwork and be able to live according to my energy levels. I also wanted the flexibility to be able to travel and earn at the same time.

For me it was a win win situation because the products have given me the energy and wellbeing to be able to live my life with more enthusiasm, and also through buying the products I now have a way to earn with only 2 hours required per day.

Now that’s what I would call work life balance"

Bernadette McGowan

"At age 60, after too many years in corporate and working in the Food Transport Industry, and fast approaching retirement age, I knew I wanted to get out of the 9-5 grind, no more morning commute, no trading my time for money, no more checking my bank account to see if I had enough to pay the mortgage, bills, and put food on the table.

This product and associated business opportunity ticked all the boxes, and was just a ‘no brainer”. I knew I had to ‘Do it”…

The best investment I have ever made"

Enagic

Certifications

Enagic International is certified to ISO 9001, ISO 14001, and ISO 13485 for quality control and environmental management, the Water Quality Association Gold Seal for product certification, and a member in good standing of the prestigious Direct Selling Association.

Introducing

Kangen Ukon Turmeric Tea

Enjoy your daily Ukon® with a delicious cup of tea!

Kangen Ukon® Tea is made with curcumin (the most active component of wild turmeric), and is cultivated in the rich soil of northern Yanburu, Okinawa.

Preparing Ukon® Tea:

Steep 1 Ukon® tea bag in boiling Kangen Water® for optimal flavor and health benefits.

Stir tea bag until desired strength and taste is reached.

Enjoy hot or cold.

Tumeric & Honey Soap Organic

Healthy product manufactured in Japan. Freshly harvested from the Ukon Garden in Okinawa. This soap is carefully crafted by a traditional bar soap maker.

It is a living soap that makes the most out of natural ingredients

A natural soap made to rejuvenate and keep your skin healthy. It can also be used as shampoo and it leaves your hair clean and soft.

Who is Grandma Possibility?

Pam Salter is a retired clinical nurse, author, entrepreneur, and retirement advocate. Her own retirement journey, marked by unexpected challenges and profound discoveries, inspired her to share her wisdom and insights with others. Through her book "Before It's Too Late" and her dedicated business, Pam empowers retirees to embrace their later years with confidence and purpose.

What is "Before It's Too Late" about?

"Before It's Too Late" is a must-read book by Pam Salter that challenges the traditional view of retirement. Through her wisdom and stories, Pam inspires readers to thrive in this vibrant phase of life, where opportunities abound. The book encourages individuals to take control of their lives and create the retirement they've always wanted, starting today.

What topics does Pam cover in her blog?

Pam's blog covers a range of topics related to retirement, health, and fulfillment. From discussing the pitfalls of retirement to sharing insights on maintaining optimal physical and mental health, Pam provides valuable advice and inspiration for individuals navigating this life transition.

What is Kangen Water, and how does it relate to retirement?

Kangen Water is a high-quality water product enriched with molecular hydrogen and essential alkaline minerals. It offers numerous health benefits, including antioxidant properties, detoxification, and digestive health support. By promoting hydration and overall well-being, Kangen Water contributes to a fulfilling retirement lifestyle focused on vitality and longevity.

How can I prepare for retirement with Pam's guidance?

Pam Salter offers guidance and resources to help individuals prepare for retirement with confidence and enthusiasm. Whether it's addressing health concerns, financial stability, or finding purpose beyond work, Pam's approach empowers retirees to embrace this new chapter of life with energy and optimism. Through her programs and personalized support, individuals can navigate the transition to retirement with clarity and purpose.

How can I join Pam's retirement empowerment programs?

If you're interested in changing the narrative of your retirement journey and discovering purpose and fulfillment, you can click on the provided link to learn more about Pam's programs and how to get involved. Pam provides the guidance and support needed to thrive in retirement.

© 2024 Pamela Salter